Marijuana legalization has transformed the United States in more ways than one, with its economic effects taking center stage. As of 2025, with 24 states and Washington, D.C., having legalized recreational marijuana and 38 states allowing medical use, the cannabis industry is a powerhouse driving jobs, tax revenue, and local growth. But what does the data really say about its economic impact? This article dives into the numbers to uncover the truth behind marijuana legalization’s financial footprint.

A Booming Industry: Jobs and Market Growth

One of the most tangible benefits of marijuana legalization is job creation. The cannabis sector has become a significant employer, supporting hundreds of thousands of workers across the country. According to industry estimates, the U.S. cannabis market employed over 440,000 full-time equivalent workers in 2024, with projections suggesting further growth in 2025 as more states join the legalization wave.

- Direct Jobs: Dispensaries, cultivation facilities, and processing plants are the backbone of this industry. For instance, the average medical marijuana dispensary employs 6.2 workers, and with nearly 15,000 dispensaries nationwide, that translates to roughly 93,000 jobs in retail alone.

- Indirect Jobs: Beyond the plant itself, legalization boosts secondary industries like construction, legal services, and technology, amplifying its economic reach.

Market growth tells a similar story. The U.S. cannabis industry generated $31.4 billion in sales in 2024, with forecasts from Whitney Economics predicting $35.2 billion in 2025—a 12.1% increase. This rapid expansion underscores marijuana’s role as a key economic driver.

Tax Revenue: A Game-Changer for State Budgets

Legal marijuana isn’t just about sales—it’s a goldmine for tax revenue. States that have embraced legalization are reaping the rewards, funding schools, roads, and public services with cannabis taxes.

- Colorado’s Success: Since legalizing recreational marijuana in 2012, Colorado has collected over $2 billion in cannabis tax revenue by 2025. In 2024 alone, the state brought in $387 million, averaging more than $20 million monthly.

- California’s Haul: As the largest cannabis market, California generates over $50 million monthly in tax revenue, dwarfing many traditional industries.

- National Impact: Across legal states, cannabis tax revenue hit $20 billion cumulatively by 2024, nearly double the tax haul from alcohol, according to industry reports.

This influx of funds has allowed states to offset the costs of enforcement and invest in community priorities, proving that legalization pays dividends beyond the dispensary counter.

External Link: Want the latest on cannabis tax trends? Check out the Tax Foundation for detailed breakdowns.

Economic Ripple Effects: Beyond the Numbers

The economic benefits of marijuana legalization extend far beyond direct sales and taxes. The industry creates a ripple effect, stimulating local economies in unexpected ways.

- Real Estate Boom: Legalization boosts demand for commercial properties as dispensaries and cultivation sites spring up. A 2021 study found that home values in legal recreational states rose $6,337 more than in non-legal states between 2017 and 2019—a trend that continues into 2025.

- Consumer Spending: Cannabis workers earn a median salary of $58,511—11% above the national median—giving them more disposable income to spend locally.

- Small Business Growth: Dispensaries, often small businesses, reinvest profits into their communities, driving further economic activity.

According to MJBizDaily, the total economic impact of marijuana sales reached $115.2 billion in 2024, with projections nearing $150 billion by 2026. This multiplier effect—where every dollar spent at a dispensary generates additional economic activity—highlights cannabis as a catalyst for broader prosperity.

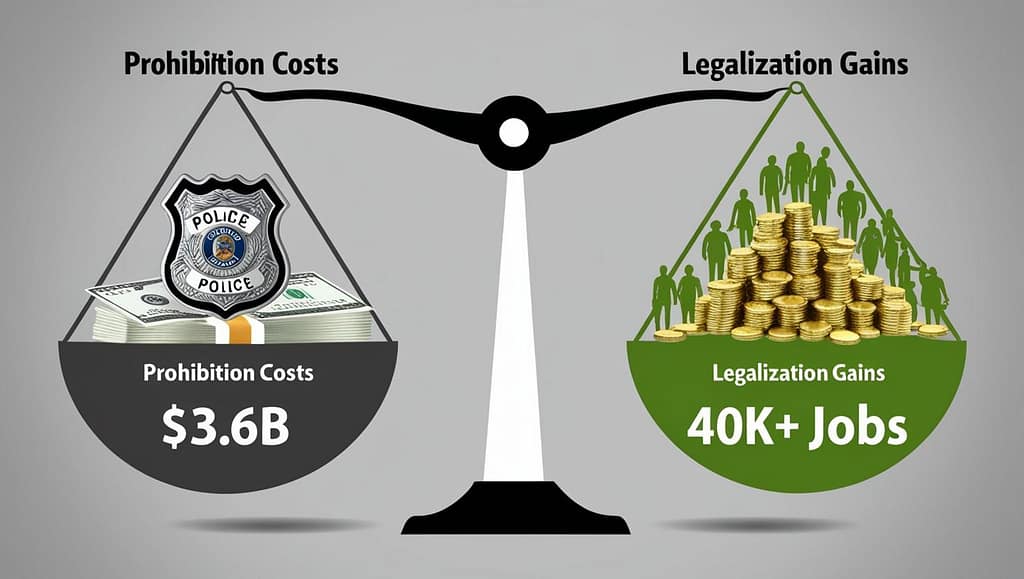

The Cost of Prohibition vs. Legalization

Critics often point to the costs of legalization, like regulatory oversight or public health concerns, but how do these stack up against the price of prohibition? The data paints a clear picture.

- Enforcement Savings: The U.S. spends an estimated $3.6 billion annually on federal marijuana law enforcement. Legalization reduces this burden, freeing up resources for other priorities.

- Lost Revenue: Prohibition forfeits billions in potential tax revenue. Some estimates suggest the U.S. misses out on $30 billion yearly by not fully legalizing cannabis nationwide.

When Colorado spends $4.50 to mitigate legalization’s effects for every $1 in tax revenue (per a Centennial Institute study), it’s still a net gain compared to the sunk costs of enforcement with no return under prohibition.

Challenges and Caveats

Legalization isn’t without hurdles. The federal ban on marijuana creates banking barriers, limiting industry growth. Businesses can’t access traditional loans, and many operate cash-only, stunting their potential. Additionally, early legalizing states like Colorado and California enjoy a “first-mover advantage,” capturing larger economic gains than late adopters like Mississippi, which saw a modest $30 million boost in 2023.

Social costs—such as increased substance use disorders or homelessness—also temper the economic upside. A Federal Reserve Bank of Kansas City study found a 17% rise in substance use disorders and a 35% increase in chronic homelessness post-legalization. However, these costs are often concentrated among specific populations, while economic benefits are more widely distributed.

Future Outlook: A $150 Billion Industry?

As federal discussions about reclassifying marijuana from Schedule I to Schedule III heat up in 2025, the economic potential could skyrocket. Full legalization could unlock $128.8 billion in tax revenue and 1.6 million jobs nationwide, according to Forbes estimates. With public support at 88% (Pew Research, 2024), the momentum is undeniable.

External Link: Curious about industry projections? Dive into MJBizDaily for the latest forecasts.

Frequently Asked Questions (FAQ)

Q: How much tax revenue does marijuana legalization generate?

A: Legal states collected $20 billion by 2024, with individual states like Colorado averaging $20 million monthly.

Q: Does legalization create more jobs than it costs?

A: Yes, with over 440,000 jobs supported in 2024, the industry far outweighs enforcement-related job losses.

Q: What’s the biggest economic challenge for the cannabis industry?

A: The federal ban limits banking access, hindering growth despite state-level success.

Conclusion

The economic impact of marijuana legalization in the U.S. is no longer a matter of speculation—it’s a data-driven reality. From job creation and tax revenue to real estate booms and local spending, the numbers reveal a thriving industry poised for even greater growth. While challenges remain, the financial case for legalization is stronger than ever. As 2025 unfolds, the question isn’t whether marijuana boosts the economy, but how much further it can take us.

Have thoughts on legalization’s economic effects? Drop a comment below, and subscribe for more cannabis insights!

Note: Data reflects estimates as of March 8, 2025. Economic impacts may vary by state and evolve with policy changes.